Cable Assembly Manufacturers For Sale : 5 Prime Opportunities

In today’s dynamic market, the Cable Assembly Manufacturers For Sale stands as a pivotal component of various sectors, ranging from electronics to automotive and beyond. As opportunities emerge and evolve, the prospect of acquiring or selling cable assembly manufacturers presents itself with promising potential. This article delves into the intricate landscape of cable assembly businesses for sale, offering insight into market dynamics, financial considerations, operational assessments, and strategic transitions. Whether you’re an investor seeking lucrative ventures or a business owner contemplating a sale, understanding the nuances of this industry can unlock valuable opportunities. Join us as we explore the realm of cable assembly manufacturers for sale, where strategic decisions pave the path for future success and growth.

Understanding the Cable Assembly Industry

The cable assembly industry is a vital link in the broader supply chain of various sectors, encompassing electronics, telecommunications, automotive, aerospace, healthcare, and more. Cable assemblies play a crucial role in facilitating the transmission of power, signals, and data within complex systems. Understanding the nuances of this industry is essential for investors and business owners alike.

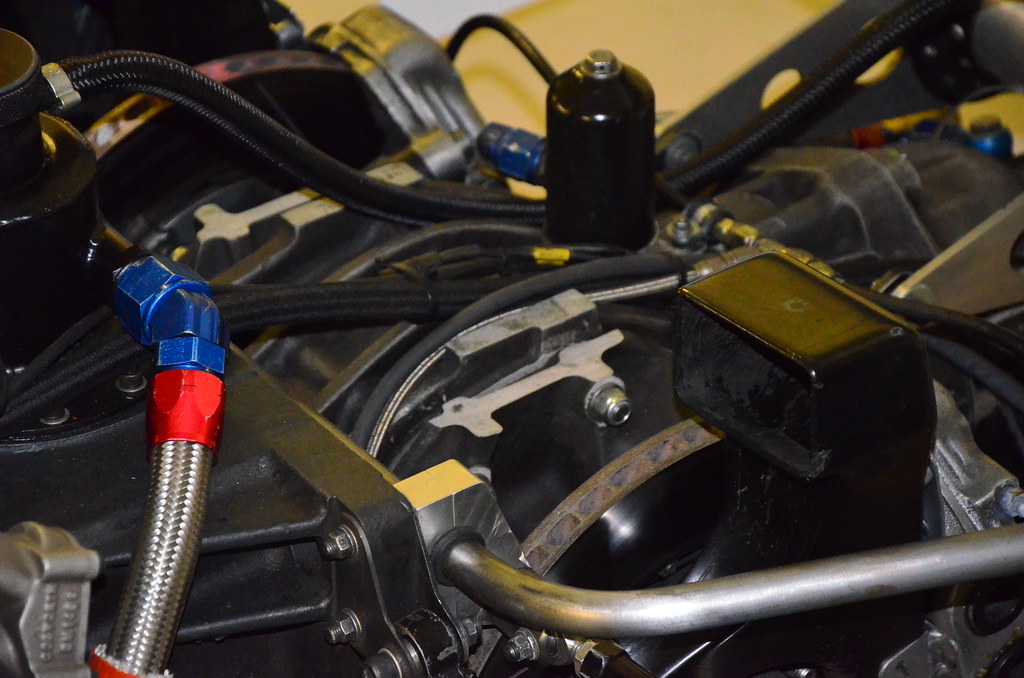

Key Components and Functionality: Cable assemblies consist of cables, connectors, terminals, and other components intricately assembled to form a functional unit. These units serve diverse purposes, including power distribution, signal transmission, and data communication. The design and construction of cable assemblies are tailored to specific applications, ensuring optimal performance and reliability in various environments.

Market Dynamics and Growth Drivers: The cable assembly market is influenced by several factors, including technological advancements, industry regulations, and shifts in consumer demand. With the proliferation of IoT (Internet of Things) devices, electric vehicles, and renewable energy solutions, the demand for custom cable assemblies continues to rise. Additionally, innovations in wireless communication technologies and the advent of 5G networks contribute to the evolving landscape of the cable assembly industry.

Challenges and Opportunities: While the cable assembly industry presents lucrative opportunities, it also poses certain challenges. Market saturation, price competition, and supply chain disruptions are among the primary concerns faced by manufacturers. Moreover, stringent quality standards and compliance requirements necessitate continuous investment in research, development, and regulatory adherence. However, embracing emerging technologies, implementing lean manufacturing practices, and diversifying product offerings can position companies for sustainable growth and competitive advantage.

Global Market Trends: The global cable assembly market exhibits regional variations and sector-specific trends. Asia-Pacific dominates the market share, driven by the presence of key manufacturing hubs and the growing demand for consumer electronics and automotive applications. North America and Europe remain significant contributors, leveraging technological innovations and stringent quality standards to maintain market leadership.

Evaluating Cable Assembly Manufacturing Businesses

Evaluating cable assembly manufacturing businesses requires a comprehensive approach that encompasses financial, operational, and strategic considerations. Whether you’re considering the acquisition of a cable assembly company or preparing to sell your own, a thorough assessment is essential to inform decision-making and maximize value.

Financial Analysis:

- Revenue and Profitability: Assess the historical financial performance of the business, including revenue trends, profit margins, and cash flow dynamics. Analyze key financial metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) to gauge profitability and operational efficiency.

- Customer Base and Revenue Diversification: Evaluate the diversity and stability of the customer base. Determine the extent to which revenue is concentrated among a few key customers or diversified across multiple sectors and geographies. A diversified customer portfolio mitigates risk and enhances long-term sustainability.

- Cost Structure and Operational Efficiency: Examine the cost structure of the business, including raw materials, labor, and overhead expenses. Identify opportunities for cost optimization, process improvement, and operational efficiency enhancements. Streamlining production processes and implementing lean manufacturing principles can enhance profitability and competitiveness.

Operational Assessment:

- Production Capacity and Scalability: Evaluate the production capacity of the manufacturing facilities and assess scalability to accommodate future growth and demand fluctuations. Consider factors such as equipment utilization rates, lead times, and production flexibility. Investing in automation and technology upgrades can increase throughput and scalability.

- Quality Control and Compliance: Ensure adherence to quality standards, regulatory requirements, and industry certifications such as ISO 9001 and IPC-A-620. Conduct a thorough review of quality control processes, testing procedures, and compliance documentation. A robust quality management system enhances product reliability and customer satisfaction.

- Supply Chain Management: Evaluate the resilience and reliability of the supply chain, including sourcing of raw materials, component availability, and supplier relationships. Identify potential supply chain risks such as material shortages, geopolitical factors, and transportation disruptions. Developing strategic supplier partnerships and implementing inventory management strategies can mitigate supply chain risks.

Strategic Considerations:

- Market Positioning and Competitive Landscape: Assess the company’s market positioning, competitive advantages, and differentiation strategies. Analyze competitors, market dynamics, and emerging trends to identify opportunities for growth and differentiation. Developing a clear value proposition and strategic positioning can enhance market competitiveness and value proposition.

- Technological Innovation and Product Development: Evaluate the company’s investment in research and development, technological innovation, and product diversification. Assess the portfolio of products and services, technological capabilities, and innovation pipeline. Embracing emerging technologies such as Industry 4.0, IoT integration, and automation can drive product innovation and competitive differentiation.

- Management Team and Organizational Capabilities: Assess the strength and experience of the management team, organizational structure, and leadership capabilities. Evaluate succession planning, talent retention, and organizational culture. A strong leadership team with relevant industry experience and strategic vision is critical for long-term success and value creation.

Financial Assessment of Cable Assembly Manufacturers

Conducting a thorough financial assessment is crucial when evaluating cable assembly manufacturers for sale. This process involves analyzing various financial metrics, identifying key performance indicators, and assessing the overall financial health and viability of the business. Here’s a detailed overview of the components involved in the financial assessment:

1. Revenue Analysis:

- Review historical revenue trends over multiple periods to identify growth patterns and fluctuations.

- Assess revenue diversification across customer segments, industries, and geographic regions.

- Analyze revenue concentration risk by evaluating the contribution of top customers to total revenue.

2. Profitability Metrics:

- Calculate key profitability metrics such as gross profit margin, operating profit margin, and net profit margin.

- Compare profitability metrics to industry benchmarks and historical performance to assess operational efficiency.

- Identify factors impacting profitability, such as pricing pressure, cost structure, and economies of scale.

3. Cash Flow Analysis:

- Evaluate cash flow dynamics, including operating cash flow, investing cash flow, and financing cash flow.

- Assess working capital management practices, including accounts receivable, inventory turnover, and accounts payable.

- Analyze cash flow projections and liquidity reserves to assess the company’s ability to meet short-term and long-term obligations.

4. Balance Sheet Review:

- Analyze the balance sheet to assess the company’s financial position and leverage.

- Evaluate asset composition, including property, plant, and equipment, and assess asset utilization rates.

- Review liabilities, including short-term and long-term debt obligations, to evaluate solvency and debt service capabilities.

5. Capital Structure and Financing:

- Review the company’s capital structure, including equity financing and debt financing.

- Assess the cost of capital and evaluate the company’s ability to access additional financing if needed.

- Analyze debt maturity profiles and debt covenants to understand repayment obligations and financial risk.

6. Financial Ratios and Metrics:

- Calculate key financial ratios such as return on investment (ROI), return on assets (ROA), and return on equity (ROE).

- Evaluate liquidity ratios, leverage ratios, and efficiency ratios to assess financial performance and risk.

- Compare financial ratios to industry benchmarks and peer group averages to identify areas of strength and improvement.

7. Projections and Forecasts:

- Develop financial projections and forecasts based on historical performance, market trends, and growth opportunities.

- Incorporate assumptions regarding revenue growth, cost structure, and investment requirements into financial models.

- Sensitivity analysis and scenario planning can help assess the impact of different variables on financial outcomes.

8. Due Diligence and Verification:

- Verify financial information through due diligence processes, including review of audited financial statements, tax returns, and supporting documentation.

- Engage financial advisors, accountants, and valuation experts to provide independent assessments and validation of financial data.

- Identify any potential discrepancies or irregularities that may impact the valuation or transaction process.

Operational Analysis and Efficiency Measures

An operational analysis is crucial when evaluating cable assembly manufacturers for sale. This process involves assessing various aspects of the company’s operations to identify strengths, weaknesses, and opportunities for improvement. Here’s a detailed overview of the components involved in the operational analysis:

1. Production Processes and Capacity:

- Evaluate the efficiency and effectiveness of production processes, including assembly lines, equipment utilization, and workflow management.

- Assess production capacity relative to current demand and future growth projections.

- Identify bottlenecks, inefficiencies, and areas for optimization to enhance throughput and scalability.

2. Quality Control and Assurance:

- Review quality control procedures, testing protocols, and inspection processes to ensure adherence to industry standards and customer requirements.

- Evaluate the effectiveness of quality management systems in identifying and addressing defects or non-conformities.

- Implement continuous improvement initiatives and corrective actions to enhance product quality and customer satisfaction.

3. Inventory Management and Supply Chain Integration:

- Assess inventory management practices, including inventory levels, turnover rates, and lead times.

- Evaluate supplier relationships, procurement strategies, and supply chain resilience.

- Implement just-in-time (JIT) inventory systems and vendor-managed inventory (VMI) programs to optimize inventory levels and reduce carrying costs.

4. Lean Manufacturing Principles:

- Apply lean manufacturing principles and methodologies to eliminate waste, reduce lead times, and improve efficiency.

- Implement 5S (Sort, Set in order, Shine, Standardize, Sustain) practices to organize the workplace and maintain a clean and orderly environment.

- Utilize value stream mapping and process optimization techniques to identify opportunities for streamlining operations and reducing costs.

5. Technology Integration and Automation:

- Embrace technological innovations and automation solutions to enhance productivity and efficiency.

- Invest in advanced manufacturing technologies such as robotics, CNC machining, and additive manufacturing.

- Integrate digital tools and software systems for production planning, scheduling, and real-time monitoring of key performance indicators (KPIs).

6. Employee Training and Development:

- Invest in employee training and development programs to enhance skills, knowledge, and competencies.

- Provide cross-training opportunities to enable flexibility and agility in workforce deployment.

- Foster a culture of continuous learning, innovation, and collaboration to drive operational excellence.

7. Environmental Sustainability and Compliance:

- Implement environmentally sustainable practices and initiatives to minimize environmental impact.

- Ensure compliance with regulatory requirements, environmental standards, and occupational health and safety regulations.

- Adopt eco-friendly materials, energy-efficient technologies, and waste reduction measures to promote sustainability and corporate social responsibility.

8. Continuous Improvement and Kaizen Philosophy:

- Foster a culture of continuous improvement and innovation based on the Kaizen philosophy.

- Encourage employee involvement and participation in problem-solving and process improvement initiatives.

- Implement feedback mechanisms, performance metrics, and regular reviews to monitor progress and drive continuous improvement efforts.

Regulatory Compliance and Quality Standards

In the cable assembly manufacturing industry, regulatory compliance and adherence to quality standards are paramount considerations that ensure product safety, reliability, and customer satisfaction. This section delves into the intricate landscape of regulatory requirements and quality assurance practices that govern cable assembly manufacturers:

1. Regulatory Framework:

- Familiarize with industry-specific regulations and standards governing cable assembly manufacturing, including safety standards, environmental regulations, and product certification requirements.

- Stay abreast of regulatory updates and changes to ensure ongoing compliance and adherence to legal obligations.

- Engage with regulatory agencies, industry associations, and certification bodies to interpret and implement regulatory requirements effectively.

2. Quality Management Systems (QMS):

- Establish and maintain robust quality management systems compliant with international standards such as ISO 9001:2015.

- Implement documented procedures, quality control protocols, and inspection processes to ensure consistency and conformance to specifications.

- Conduct regular audits and reviews to assess the effectiveness of the QMS and identify areas for improvement.

3. Product Certification and Testing:

- Obtain relevant certifications and approvals for cable assemblies, including UL (Underwriters Laboratories), CSA (Canadian Standards Association), and CE (Conformité Européenne) markings.

- Conduct rigorous product testing, validation, and certification processes to verify compliance with regulatory requirements and industry standards.

- Collaborate with accredited testing laboratories and certification agencies to validate product performance and safety characteristics.

4. Material Compliance and Traceability:

- Ensure compliance with material restrictions and substance regulations such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals).

- Implement material traceability systems to track the origin, composition, and usage of materials throughout the supply chain.

- Maintain accurate documentation and records of material certifications, compliance declarations, and supplier declarations of conformity.

5. Process Validation and Verification:

- Validate critical manufacturing processes, equipment, and production methodologies to ensure consistent product quality and performance.

- Conduct process validation studies, statistical analysis, and control measures to mitigate process variability and ensure product repeatability.

- Implement process monitoring and verification mechanisms to detect deviations, non-conformities, and opportunities for process improvement.

6. Risk Management and Mitigation:

- Identify and assess potential risks and hazards associated with cable assembly manufacturing processes, materials, and end-use applications.

- Implement risk mitigation strategies, preventive measures, and contingency plans to address identified risks and minimize adverse impacts.

- Foster a culture of risk awareness, proactive problem-solving, and continuous improvement to enhance resilience and responsiveness.

7. Customer Satisfaction and Feedback:

- Solicit customer feedback, satisfaction surveys, and performance evaluations to gauge customer perceptions and expectations.

- Respond promptly to customer inquiries, complaints, and quality issues to address concerns and demonstrate commitment to quality and customer satisfaction.

- Incorporate customer feedback into product design, process improvement, and quality assurance initiatives to drive customer-centricity and enhance value proposition.

Conclusion

In conclusion, the exploration of cable assembly manufacturers for sale unveils a landscape rich with opportunities and challenges.

Through comprehensive evaluations of financial viability, operational efficiency, regulatory compliance, and quality standards, investors and stakeholders gain invaluable insights into the dynamics of this dynamic industry.

By embracing technological innovations, fostering a culture of continuous improvement, and prioritizing customer satisfaction, cable assembly manufacturers can navigate the complexities of the market with resilience and agility.

As the demand for custom cable solutions continues to evolve in tandem with technological advancements and industry trends, strategic decision-making and forward-thinking strategies are paramount for sustained success.

In the pursuit of excellence, the journey of evaluating cable assembly manufacturers for sale serves as a testament to the ingenuity, adaptability, and resilience inherent in this vibrant sector.

With diligence, foresight, and strategic foresight, stakeholders can unlock untapped potential and chart a course towards enduring prosperity in the ever-evolving landscape of cable assembly manufacturing.

FAQs (Frequently Asked Questions) About Cable Assembly Manufacturers For Sale:

1. What factors should I consider when evaluating cable assembly manufacturers for sale?

- Considerations include financial performance, operational efficiency, regulatory compliance, quality standards, market positioning, and growth potential.

2. How can I assess the financial health of a cable assembly manufacturing business?

- Evaluate revenue trends, profitability metrics, cash flow dynamics, balance sheet composition, capital structure, and financial ratios.

3. What operational aspects should I analyze when assessing a cable assembly manufacturer?

- Assess production processes, capacity, quality control measures, inventory management practices, technology integration, employee training, and environmental sustainability initiatives.

4. What regulatory requirements and quality standards govern cable assembly manufacturing?

- Cable assembly manufacturers must adhere to industry-specific regulations, safety standards, environmental regulations, product certification requirements, and material compliance standards.

5. How can a cable assembly manufacturer ensure compliance with regulatory requirements?

- Establish robust quality management systems, obtain relevant certifications, conduct product testing and validation, implement material traceability systems, and mitigate risks through proactive measures.

6. What strategies can cable assembly manufacturers employ to enhance competitiveness and customer satisfaction?

- Embrace technological innovations, foster a culture of continuous improvement, prioritize customer feedback, respond promptly to inquiries and quality issues, and align operations with customer needs and expectations.

7. What are the key considerations for investors seeking to acquire cable assembly manufacturers?

- Investors should evaluate growth potential, market positioning, financial performance, operational efficiency, regulatory compliance, quality standards, and strategic alignment with investment objectives.

8. How can cable assembly manufacturers differentiate themselves in the market?

- By offering innovative products, maintaining high-quality standards, providing exceptional customer service, embracing sustainability practices, and staying ahead of industry trends and technological advancements.

9. What are the risks associated with investing in cable assembly manufacturers?

- Risks include market volatility, competitive pressures, supply chain disruptions, regulatory changes, technological obsolescence, and economic downturns.

10. What resources are available for investors and stakeholders interested in the cable assembly manufacturing industry?

- Resources include industry reports, market analysis, regulatory guidelines, professional associations, trade publications, and consulting services specializing in cable assembly manufacturing.